Opportunities

SINGLE PROJECT OPPORTUNITIES

Park Hollow

88 townhomes planned on 8.62-acres of undeveloped soccer fields in the infill submarket of Richardson, Texas within the DFW metro area. The Project has an excellent location surrounded by primary transportation thoroughfares, shopping and amenities, and a nationally-recognized school district.

Target Returns (Annualized): 26%+

Objective: Income + Growth

Hold Period: 5+ Years

IRR: 21%+

Open Funds

SELECT FUND VI

A private real estate investment opportunity tailored for the moderate risk investor who desires both passive income and asset appreciation within a single venture. This Fund’s approach centers around, acquisition, development, and managing single-family residences in strong growth markets.

Target Returns (Annualized): 15% – 30%

Objective: Income + Growth

Hold Period: 5+ Years

IRR: 18%+

Investment Focus

TARGET MSA ATTRIBUTES

- Net Population Growth

- Net Job Growth

- Net Economic Growth

- Favorable Regulatory Environment

- Access to employment hubs, dining, entertainment & freeways / transportation

- Strong School Districts

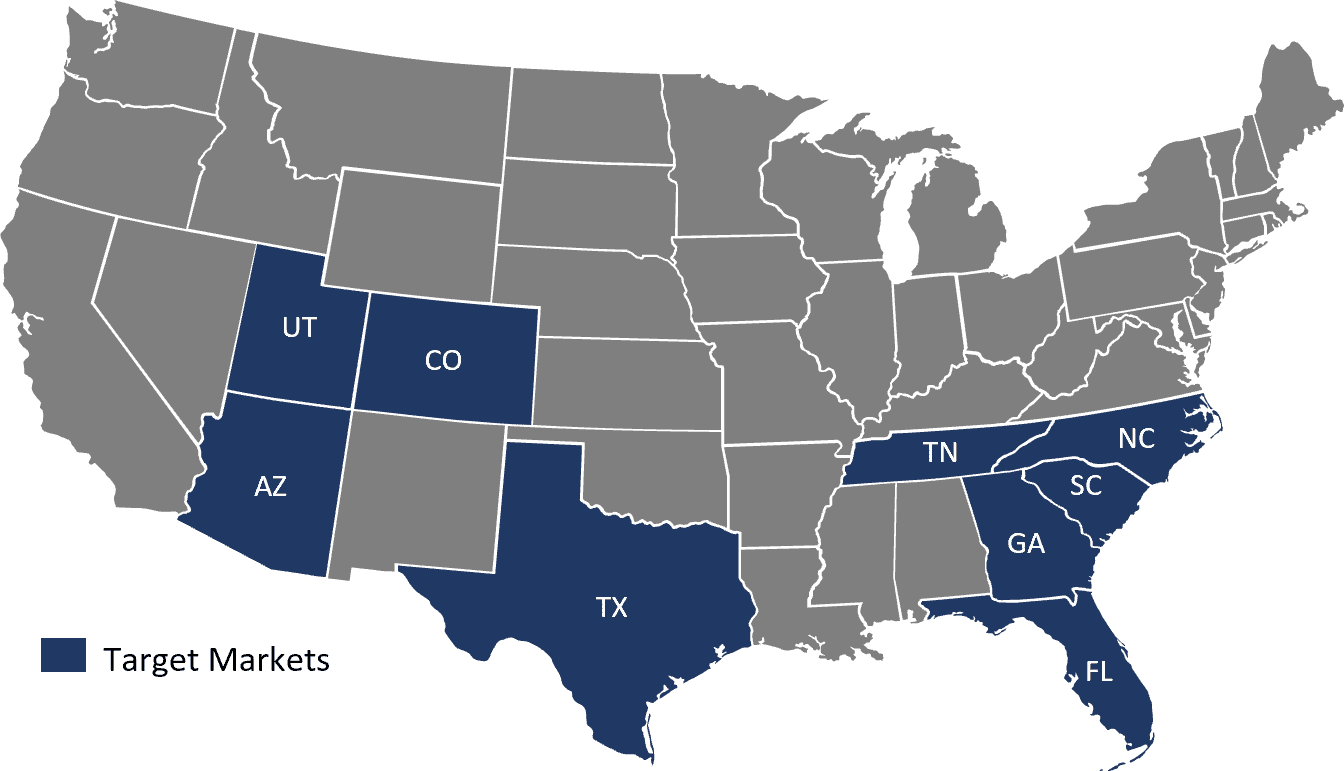

GEOGRAPHIC FOCUS | SUNBELT

Why Invest in Real Estate?

Strong Returns

Greater Stability

Diversify

Tax Benefits

FAQ

How can I invest?

Traditional Cash Investment: Utilizing post-tax funds for investment opens the door to fully embracing the tax depreciation benefits associated with real estate ownership. This strategy offers the financial perks of property investment without the direct responsibilities of property management.

Self-Directed IRA: Many clients find a significant part of their wealth tied up in retirement plans. By partnering with a custodian, you can allocate a portion of your retirement funds into a self-directed IRA. This enables you to venture into real estate investments, adding a layer of diversification to your retirement portfolio.

Capital Gains and Opportunity Zones: For clients who have realized capital gains from selling stocks, a business, or property, we provide investment opportunities in designated opportunity zones. Investing in these areas not only allows you to defer taxes on capital gains but also eliminates tax obligations on the profits earned from these projects, underlining a significant tax advantage.

What does accredited investor mean?

An accredited investor is defined by specific financial thresholds established by the SEC, granting them eligibility to engage in investment opportunities beyond those registered with the SEC. SEC.gov | Accredited Investors

Qualification Criteria:

- An individual income of $200,000 or a combined income of $300,000 for the last two years with the anticipation of sustaining or enhancing that income level in the current year.

- A net worth exceeding $1 million is necessary, with the exception of the value of your primary home.

What is IRR?

Internal rate of return (IRR) is the annualized return metric that calculates both cash flow and equity returned over the course of the entire holding period.